Are you interested in maximizing your margin limits, lowering your interest rates, accessing additional funds, and having flexibility in portfolio management in your stock trading?

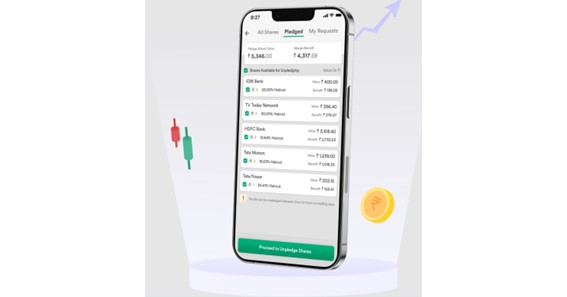

If so, then Margin Pledge Benefit may be just what you need. Margin Pledge is a process in which you pledge securities or cash to the broker as collateral for a loan to trade in the stock market.

This article discusses the four primary benefits of Margin Pledge in stock trading and how it can help you reach your financial goals.

What is Margin Pledge?

Margin Pledge is a process in which you pledge securities or cash to your broker as collateral for a loan to trade in the stock market.

This means that you can borrow money from the broker to purchase securities and use your pledged assets as a guarantee to pay back the loan.

4 Benefits of Margin Pledge in Stock Trading

By using Margin Pledge in your stock trading, you can enjoy several benefits that can help you maximize your profits and achieve your financial goals.

Here are 4 key benefits of the Margin Pledge that you should be aware of:

1. Higher Margin Limits

Higher margin limits refer to the maximum amount of money you can borrow from a broker to buy stocks. By pledging additional securities as collateral, you can increase your margin limits and potentially boost your buying power in the market.

This opens up more investment opportunities and potentially bigger rewards. The advantages of higher margin limits include the following:

- The ability to diversify your portfolio

- Take advantage of market fluctuations

- Potentially earn higher profits

2. Lower Interest Rates

Lower interest rates refer to the reduction in the cost of borrowing money for online stock market trading purposes. You may need to borrow money to acquire stocks as a stock trader. The interest rates you pay on these borrowed funds can dramatically affect your trading profitability.

With margin pledge, you can get the following benefits:

- Reduce the cost of borrowing money

- Translate into increased profitability

- Allow for greater flexibility in investment decisions

- Lead to improved cash flow management

These benefits allow you to save money on interest payments, allowing you to reinvest the funds into your trading activities, thereby maximizing your returns.

Click Here- What Is FMB Sketch?

3. Access to Additional Funds

As a stock trader, accessing additional funds can be crucial for making strategic investments and maximizing profits. Margin Pledge provides you with the benefit of accessing additional funds beyond what you currently have in your account.

By pledging securities as collateral, you can increase your buying power and take advantage of more trading opportunities. This means that you can potentially earn more profits with the same amount of initial investment.

Additionally, having access to additional funds can provide a cushion for any unexpected losses in your portfolio.

4. Flexibility in Portfolio Management

Flexibility in portfolio management is the last and major benefit of margin pledges in stock trading. By pledging your shares as collateral, you can gain access to additional funds which can be used to invest in other securities, thereby diversifying your portfolio.

You can reap various benefits from flexibility in portfolio management. Some of these benefits are as follows:

- Diversifies your portfolio

- Spreads your investment risk

- Potentially increases your returns

- Make the most of sudden opportunities

- Provides funds for timely trades

- Fits your investment goals and risk tolerance

- Gives you greater control over your financial future

Conclusion

You now understand the benefits of margin pledge in stock trading. With higher margin limits, lower interest rates, access to additional funds, and flexibility in portfolio management, margin pledge can greatly enhance your trading experience.

Consider incorporating margin pledge into your trading strategy to take advantage of these benefits.